UPDATES: SEE HOW GUYS ARE USING LATEST iPHONE 16 Pro Max TO SCAN LADIES AND GET THEIR N4KED BODY. SEE HOW THEY ARE DOING 2024 is another windfall year for Nigerian banks as the monetary authority’s hawkish policy boosted banks’ earnings but stunted operations for manufacturing companies and other businesses. ...Tap To Read The Full Story Here | ..Tap To Read The Full Story Here...

Following the floating of the exchange rate by the Central Bank of Nigeria (CBN), last year, many banks reported massive foreign exchange gains, especially banks with thick foreign currency-denominated assets.

The profits made surprisingly attracted the government’s attention as it demanded a 50 per cent windfall tax from the gains, which shareholders associations have vowed to contend to protect shareholders’ funds.

The apex bank too had its eye on the gain and had strictly warned banks not to pay dividends or meet operating expenses from it.

However, it is a pretty kettle of fish this year as CBN’s hawkish and unrelenting orthodox monetary policy boosted banks’ earnings, but stifled the operations of other businesses.

In all its monetary policy committee (MPC) meetings held this year, CBN consecutively hiked the benchmark interest rate by 875 basis points from 18.75 per cent to 27.50 per cent.

Benchmark interest rate, otherwise known as the monetary policy rate (MPR), is the official interest rate at which CBN lends money to commercial banks. The base rate guides the rates commercial banks charge their customers for loans.

The MPC in February raised the benchmark interest rate by 400 basis points to 22.75 per cent. In March it raised it by 200 basis points to 24.75 per cent and in May by 150 basis points to 26.25 per cent.

The committee continued tightening the base interest rate. In July, it raised it by 50 basis points to 26.75; in September by 50 basis points to 27.25 per cent; and by 25 basis points to 27.50 per cent in November to close the year.

According to financial experts, a hike in the benchmark interest rate leads to a higher cost of funds which discourages lending to the real sectors of the economy.

Cost of fund stokes business operations

While the continued hike in the base interest rate boosted banks’ earnings, it inversely affected the operation of other sectors of the economy including manufacturing and small and medium-sized enterprises (SMEs).

“These sectors have been craving a breath of fresh air as the MPC members of CBN hawked votes to tighten the benchmark interest rates,” a renowned economist, Muda Yusuf said.

Yusuf described the orthodox policy choice of the apex bank as being at variance with the mood of most economic players and the desire to promote economic recovery and growth.

“What manufacturers and other investors need at this time is some oxygen and stimulus, not policy measures that would worsen an already suffocating situation,” he said in September.

His advice was that the private sector should not be made to pay for the price of liquidity growth, which it was not responsible for.

“A hike in interest rates increases the cost of funds and is detrimental to investment and growth in the Nigerian economy,” Yusuf said.

“We believe that the policy decisions of the CBN are most inappropriate for the prevailing economic conditions and the challenges faced by entrepreneurs in the country,” he maintained.UPDATES: SEE HOW GUYS ARE USING LATEST iPHONE 16 Pro Max TO SCAN LADIES AND GET THEIR N4KED BODY. SEE HOW THEY ARE DOING

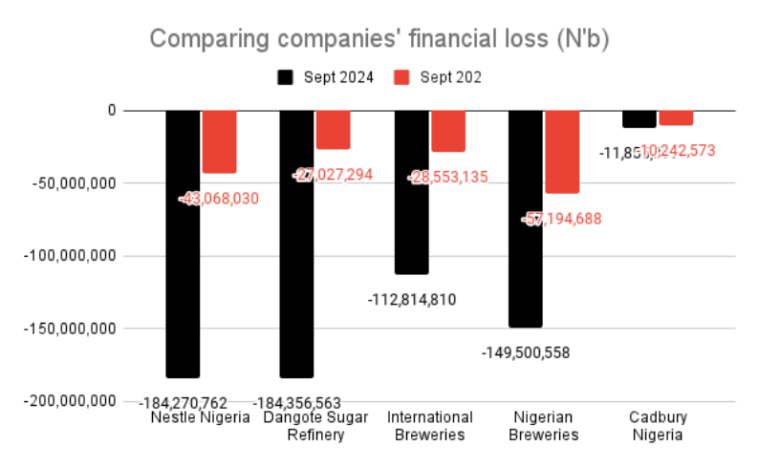

A cursory look at the nine-month financial statements that ended September 30, 2024, of some manufacturing companies revealed negative operating performances.

Nigerian Breweries reported N64.30 billion; International Breweries, N112.82 billion; Dangote Sugar Refinery, N184.36 billion; Cadbury Nigeria, N11.86 billion; and Nestle Nigeria; N184.27 billion in losses after tax.

This indicated that the operating and production costs of many businesses were further exacerbated by the CBN’s hawkish policy, resulting in negative financial performances as suffered by the above manufacturing companies.

Private-sector business activity contracted

The CBN has been raising the benchmark interest rates to rein in inflation which throttled to 34.60 per cent in November from 29.90 per cent in January.

Inflation, which increases businesses operating costs and reduces the purchasing power of consumers, made private sector business activities contract for five consecutive months, according to the monthly Purchasing Managers’ Index (PMI) report, an economic indicator that measures the health of the manufacturing and service sectors.

In July, business activities declined to 49.2 points from 50.1 in June. It remained contracted in August at 49.9 points, 49.8 points in September, 46.9 points in October, and 49.6 points in November.

The report which is published by Stanbic IBTC Bank indicates that when the PMI reading is above 50.0 points, it signals an improvement in business conditions, but below 50.0 readings show a deterioration in business activity.

A windfall year for banks

Nigerian banks’ bottom-line profits were boosted by the CBN increasing rate hike contrary to the impact it had on other businesses, a look at their nine-month financial performances reveals.

Access Holdings reported the highest interest earnings of N2.397 trillion in September 2024 relative to N962.88 billion in 2023. This is followed by Zenith Bank which posted N1.95 trillion from N670.93 billion.

Ecobank Transnational Incorporated (ETI) earned N1.93 trillion from an interest income relative to N805.11 billion, United Bank for Africa (UBA), N1.798 trillion from N666.29 billion, and FBN Holdings, N1.63 trillion from N617.06 billion.

Guaranty Trust Holding Company (GTCO) also reported a huge interest income of N980.34 billion compared to N374.56 in the review period as well as other banks represented in the chart.

The head of Financial Institutions Rating at Agusto & co, Ayokunle Olubunmi, explained that the significance seen in the earnings resulted because the growth of the interest income far outweighs the interest expenses.UPDATES: SEE HOW GUYS ARE USING LATEST iPHONE 16 Pro Max TO SCAN LADIES AND GET THEIR N4KED BODY. SEE HOW THEY ARE DOING

“Don’t forget that some of the assets that brought about the banks’ growth in interest income are in foreign currency and the interest income also will be in foreign currency,” he told The ICIR...Tap To Read The Full Story Here.